Equity Analysts analyze companies' financial reports and conduct interviews with both company management and industry professionals in order to determine the company's overall financial worth and to offer advice on investments. Skills often highlighted on the resume of an Equity Analyst include assisting in the research of equity positions for the GOP portfolio, and continually monitoring /5() The price of a single paper depends on many factors. The main ones are, naturally, the number of Buy Side Equity Research Analyst Resume pages, academic level, and your deadline. Thus, there will be a significant difference between an urgent master's paper and a /10() Sep 21, · If you’re interviewing for private equity or venture capital roles, you could also make the Spark more “operational” and talk about how you improved or helped turn around a business. Growing Interest: You developed your interest with a buy-side internship, more personal investing, a student investment club, and other blogger.comted Reading Time: 9 mins

Buy-Side Resume Walkthrough: How to Pitch Yourself

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! So you need to tell a story where investment banking was just a step in the path — a part of your plan all along to work full-time as an investor.

You did banking to gain broader deal and industry exposure, and to improve your valuation, modeling, and deal analysis skills, buy side equity research analyst resume. But you wanted the broadest possible deal experience buy side equity research analyst resume industry exposure, as well as more refined modeling and valuation skills, buy side equity research analyst resume you decided to do investment banking first.

You gained those skills, but you want to get back to your original interest and think more critically about companies and deals. Ideally, you will be able to name specific portfolio companies, buy side equity research analyst resume, deals, or positions in the last point because you should customize your story for each firm, buy side equity research analyst resume. You should outline a short, second version of your story, and then a longer, minute version.

I worked at JRJ and then at JP Morgan Leveraged Finance, buy side equity research analyst resume, and now I want to combine my LevFin and PE experience and work on financial services investments, which your firm specializes in. I joined Morgan Stanley after graduation and worked in credit risk and real estate investment banking, and now I want to combine those skills with my original interest in real estate and focus on debt investments in the sector.

I went to Grove Street after graduation to gain more deal and modeling experience, worked on co-investments there, and now I want to move into distressed debt investing to combine my previous experience with my interest in credit. If you made it into investment banking without prior internships that are relevant to this role, cite something else to explain your interest:.

Focus on the experiences that help your case the most. Every interaction in the job search IS an interview, and your story is the most critical part of that. If you have poor reasons for applying to buy-side roles when you speak with headhunters, your search is over. In his spare time, he enjoys memorizing obscure Excel functions, editing resumes, obsessing over TV shows, traveling like a drug dealer, and defeating Sauron. Free Exclusive Report: page guide with the action plan you need to break into investment banking - how to tell your story, network, buy side equity research analyst resume, craft a winning resume, and dominate your interviews.

Beginning: Grew up in [xx]. Majored in [xx] and was a varsity athlete in sport [xx] at [xx]. Decided to go into banking because I was fascinated by how companies and investors made capital allocation decisions. Spark: During my first year in banking, I had a number of debates regarding the merits of single-stock investing with a second year in my group. After many debates, the buy side equity research analyst resume year asked me to read Margin of Safety and see if I still clung to the efficient market hypothesis after reading it.

Growing Interest: Read Margin of Safety and became enthralled with idea of value investing. I continued to read up on the subject, reading other books by famous value investors like Ben Graham, Howard Marks and Joel Greenblatt.

Great, thanks Brian! Agree with your approach on talking about having done some investing on my own. I think I can also add in a line about in the into about how I wrote my senior thesis on investing — more from an academic perspective — but still displays an early interest. Thank you for the informative post — I am currently a senior at an Ivy majoring in biology, and I will be starting full-time in healthcare team at a BB.

I was curious whether you have any specific advice for me since I literally had zero finance internship or school activities. I would use your remaining time between now and when you start working to enter investment competitions, find healthcare stocks you like and trade them, or do something else finance-related. could help you tell your story.

I just got started at a pretty well known middle market IB shop in NY. I had one brief internship on the buy side during school and have been lucky enough as a first year to be placed on live deals which will probably close by year end I work in a consumer group. What would you see as the best course of action? So I would start by contacting friends and acquaintances at bigger banks and seeing if they can refer you to recruiters.

Then, research some hedge funds that focus on the strategy you prefer, and begin reaching out yourself via LinkedIn or just find the people on LinkedIn and email them by guessing the email format.

The frenzy that happens early buy side equity research analyst resume mostly applies to the PE mega-funds. I graduated from an Ivy this past May, with extensive internship experience ranging from investment management at a bulge bracket bank, sales at a top asset management firm, and then equity research at a hedge fund all in NYC.

I definitely want to pursue a market-facing role after my two years at Google, preferably at a hedge fundbut just wondering how that would work for someone with my type of background? Maybe apply to tech-focused hedge funds or asset management firms and say that you worked at Google to learn a tech buy side equity research analyst resume and buy side equity research analyst resume finances inside and out, since you want to focus on tech investing in the future.

Your email address will not be published. by Brian DeChesare Comments Print as PDF. Break Into Investment Banking. We respect your privacy. Please refer to our full privacy policy. You must confirm the statement above and enter a valid email address to receive this free content. Comments Read below or Add a comment. RLG August 22, Sara September 25, Mike September 25, Mike October 4, Sate September 24, GPP September 21, Leave a Reply Cancel reply Your email address will not be published.

This website and our partners set cookies on your computer to improve our site and the ads you see. To learn more about what data we collect and your privacy options, see our privacy policy. I Understand. Revoke Cookies.

Mock Equity Research Interview Question – Pitch Me A Stock

, time: 18:37Equity Analyst Resume Examples | JobHero

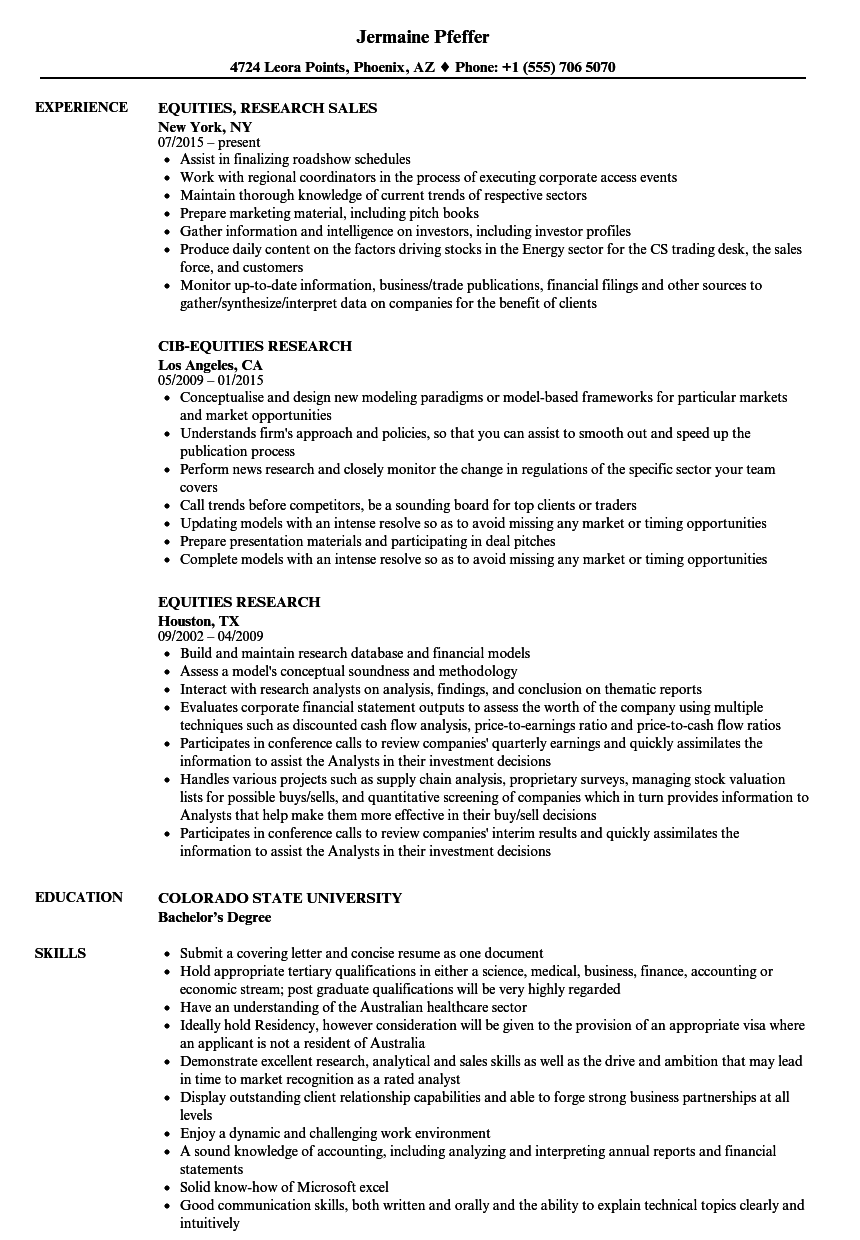

writing Buy Side Equity Research Analyst Resumeskills are tested in all areas of study. This simply means there is Buy Side Equity Research Analyst Resumeno way you can dodge writing tasks. If you opt for the unreliable writing companies that are out there, your level of disappointment is Do not try them even with the simplest essay/10() Equity Research Analyst Resume Summary: Highly qualified Equity Research Analyst with experience in the industry. Enjoy creative problem solving and getting exposure on multiple projects, and I would excel in the collaborative environment on which your company prides itself Mar 01, · Equity Research Analyst. 3/1/ – Present. Company Name. City, State. Identified and investigated investment prospects evaluating risk parameters. Researched market impact on mergers acquisitions and unique situations in order to calculate regulatory treatment. Monitored positions for potential developments adjusting position sizes where Estimated Reading Time: 40 secs

No comments:

Post a Comment